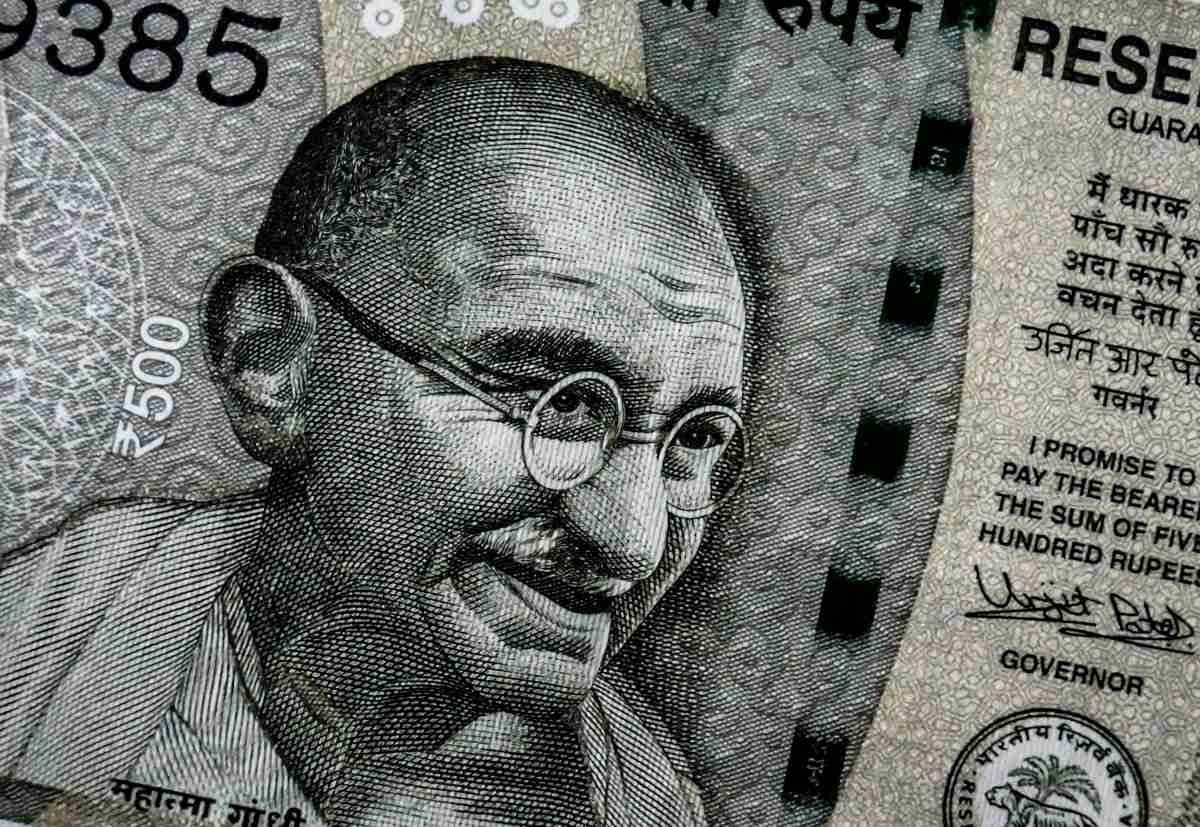

Shrinking Foreign Exchange Reserves in India

The depletion of the country's foreign exchange reserves will increase external sector vulnerabilities. The euphoria that was generated by the large increase in these reserves over the past few years has started to fade. The factors that contributed to this were the dollar's rapid depreciation and the increase in the number of dollar outflows during the last four quarters. The total foreign exchange reserves decreased from a high of $632 billion in September 2021 to $546 billion in September 2022, which is the lowest level in almost two years.

The decline in the reserves is partially attributed to the changes in the exchange rate of the various currencies that make up the basket of currencies. However, the significant portion of the decrease is due to the actions taken by the Reserve Bank of India, which intervened in the foreign exchange markets to support the Indian currency. As the rupee started to depreciate, the RBI had no choice but to sell dollars and draw down the reserves. These interventions by the Reserve Bank of India helped prevent excessive speculation and the volatility of the exchange rate of the Indian currency. They also helped minimize the impact of the country's current account position on the foreign exchange markets. These actions have depleted the country's foreign exchange reserves by almost $100 billion. Even though the Reserve Bank of India has been able to successfully manage the foreign exchange markets, the depletion of the country's reserves continues to accelerate. In the past three weeks, the decline in the reserves has averaged $5 billion. This has resulted in the reduction in the import cover of the country's currency reserves from a high of 17.1 months in March 2021 to 13 months in December 2021. According to the estimates of the Reserve Bank of India, the import cover of the country's currency has come down to around nine months by September 2022.

Rising Forex concerns in India

The sudden depletion of the foreign exchange reserves has raised concerns about the country's external sector vulnerabilities. It is also due to the actions taken by the US Federal Reserve, which has increased its interest rate cycle three times in a row. This has resulted in the import cover of the country's foreign exchange reserves falling below the levels it reached during the global financial crisis. Despite the actions taken by the Reserve Bank of India, it is still not easy to reverse the depletion of the country's foreign exchange reserves. To achieve this, the government and the private sectors need to reduce the current account and trade deficits. Unfortunately, the recent trends in the current account and trade deficits are not encouraging.

According to the data released by the Ministry of Commerce, the country's merchandise trade deficit has increased to $125 billion during the first five months of the current financial year. On the other hand, the growth in the services trade surplus has been slower than in the previous year. The small increase in the remittances by non-resident Indians can't help close the current account gaps. The prospects of a significant reduction in the trade deficits are not encouraging. Weak international freight demand has resulted in the Baltic Dry Index hitting its lowest level in over two years. The World Trade Organization also warned that the outlook for the global economy is becoming more negative. And the increasing interest rates in developed economies will only accelerate the global slowdown. This will add to the difficulties faced by service sector exporters. Even if the current account can improve in the short run, it is unlikely to do so due to the various factors that have affected it.

The Reserve Bank of India's (RBI) intervention in the foreign exchange market is one of the measures it uses to manage the volatility in the exchange rate. This could be the reason why the country's foreign exchange reserves have started to decline. The country's foreign exchange reserves had been at $553.11 billion, which is the lowest level since October 2020. Economists and experts have noted that the strengthening of the dollar against the other major currencies is one of the factors that has contributed to the decline in the country's foreign exchange reserves. In August, the Reserve Bank of India had noted that the country's foreign exchange reserves were at $573 billion, which is equivalent to about 9.4 months of imports for the current financial year. However, they are still adequate to cover the country's imports. The import cover, which measures the number of months that the country can cover with its foreign exchange reserves, was at 4.1 in May 2013.

Although the country's foreign exchange reserves are still adequate to cover its imports, they are not able to last for a long time due to the current economic situation. The country's foreign exchange reserves are not unlimited. The current account deficit, which is the country's trade imbalance, is expected to hit a record high of around 3.5 percent during the current financial year. It is estimated that the country's trade deficit could reach around $120 billion in FY23, which is equivalent to 1.2 percent of the country's GDP. The Indian rupee has also lost about 7 percent against the dollar this year. While the current account deficit is expected to reach a record high of around 3.5 percent during the current financial year, it is not considered a major issue. However, after three years of running a balanced account surplus, the country is expected to enter a balance of payment deficit for the next two years.

In addition to India and Thailand, other countries such as Indonesia and South Korea have also experienced significant drops in their foreign exchange reserves. The declining foreign exchange reserves are contributing to the increasing concerns about the potential impact of the global economic situation on emerging markets. The country's foreign exchange reserves have dropped by about $50 billion in the last six months due to the government's efforts to defend the exchange rate. This amount of money has raised concerns about the country's potential impact on the global economy. However, despite the significant decline in the reserves, the level of the country's reserves is still considered to be relatively safe.

Conclusion

The current account and capital account trends are not encouraging. Although the total foreign direct investment flows into the country have increased by about one-third during the first four months of this financial year, they have dropped significantly to $14.7 billion. This means that the country's foreign portfolio investors are not returning to the country. Although the foreign portfolio flows have started to improve in recent weeks, it is still not possible to predict the long-term trend of these flows due to the continuous rate hikes by the US Federal Reserve and the depreciation of the rupee. In addition, the recent decline in the external commercial borrowings has also affected the country's financial position. In response to the declining foreign portfolio flows, the government has taken various steps to improve the situation. Some of these include allowing foreign investors to purchase short-term corporate bonds and investing in more government securities. It also increased the bank deposit rates for non-resident Indians. The government's decision to allow the settlement of foreign trade transactions in local currency has also helped decrease the demand for dollars. However, it is still not possible to predict the long-term trend of these flows due to the current global economic situation. The only positive sign that has been received so far is that the prices of oil are expected to ease in the coming months due to the global recession. However, this can only provide temporary relief as the country's import cover continues to fall.

Pic Courtsey-Ishant Mishra at unsplash.com

(The views expressed are those of the author and do not represent views of CESCUBE.)